In Wisconsin, Tax Increment Financing (TIF) is THE most powerful local tool to guide investment and growth in ways that benefit the community.

Wisconsin’s TIF law is in some ways very rigid and in other ways very flexible regarding how communities can set up and utilize TIF districts. And it is complex, with many types of amendments and enhancements. Getting the most out of your tax increment district (TID) opportunities means being smart about when and how you open, manage, amend and close your districts.

TIF 101

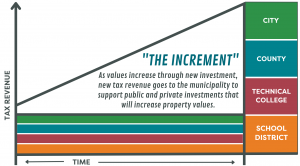

When Wisconsin’s TIF law was adopted in 1975, it was created as a financial tool for municipalities and towns to promote tax base expansion, job growth, economic development and urban renewal. The TIF mechanism allows for the costs associated with economic development of a specific defined geographic area (the tax increment district or TID) to be funded with any increase in property tax revenue or “tax increment” generated from increased property values or “value increment.”

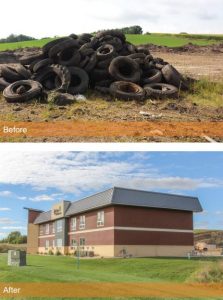

When a municipality or town is considering the creation of a TIF district, they often have specific goals or projects in mind. These might include extending infrastructure needed to develop a site for new industrial, residential or commercial use; redeveloping substandard, obsolete or vacant buildings; cleaning up polluted areas; or supporting affordable housing. Municipalities must assemble a Joint Review Board (JRB) comprised of representatives from four taxing authorities: municipal, county, school district and technical college. The role of the JRB is to approve the district’s creation and determine that, “but for” this new investment, private and public investment and development would not occur.

Throughout the life of a TIF district, the four affected taxing authorities continue to collect tax revenue on the base value of the district, which is the assessed value the year it is created. As development or redevelopment occurs and taxable value increases (value increment), the taxes on the increased value are retained by the municipality and used to support projects in (and sometimes near) the district. When the district closes, each taxing jurisdiction resumes tax collection on the full, increased value.

Wisconsin TID categories

Industrial or mixed-use TIF districts are relatively common and have a 20-year maximum life. The expenditure period for this type of district is 15 years — the time within which a community can make expenditures and complete projects. We see this category used most often in greenfield redevelopment or the creation of business parks. The mixed-use TID allows for the inclusion of new residential development. In recent years, more communities are choosing not only to include housing developments in TIF districts (as a source of new increment), but also to directly support housing projects with TIF assistance, especially for workforce and affordable housing.

South Pointe Business Park in Sparta, Wisconsin.

TIF districts created for purposes of blight elimination or rehabilitation/conservation have a 27-year maximum life and are typically located in downtown areas or areas that are already developed but in need of improvement. Because these TIDs tend to include property that is already developed, the increment is generally smaller and the payback period longer — thus the 27-year life.

Annual review

Each year by July 1, any municipality with an active TIF district or districts must file a report with the Department of Revenue for each TIF district in the community. In addition, the Joint Review Board must meet annually to review the reports. This annual review time is the perfect opportunity to reassess district performance, issues, opportunities, and whether it is under- or over-performing.

When to open a TID

Typically, a new TID is opened when private development is being proposed and the community needs to serve that new development through infrastructure improvements, site improvements, development incentives, etc. The process for creating a new TID can generally be completed within a two-to-three-month timeframe. The process involves the development of a project plan and boundaries of the proposed TID; the formation of a Joint Review Board; a public hearing by the Plan Commission, Village Board or City Council approval; and final approval by the Joint Review Board. Information is then submitted to the Department of Revenue which certifies the TIF district. The same process applies to amendments of existing districts, however, the timeframe can be shortened.

Territory and project amendments

Communities that have an existing district may want to amend their district to add projects and/or territory — or in some cases, subtract territory. There are several reasons a TID might be expanded to include more property. For example, if new development is anticipated near an existing district or if the TID is performing well and the expenditure date has not been reached, a municipality could consider adding parcels, thereby extending the TIF district territory as a whole. Parcels may only be added if contiguous to the existing TID and if the municipality’s equalized TIF value limit is below 12% for cities or villages, or between 5-7% for towns. A project plan amendment can be used to add projects to the TID project plan, but only if they’re located within ½ mile of the existing district. A TID with stronger-than-expected performance can also be leveraged to assist projects not considered or deemed feasible at the time of TID creation.

When to close a TID

As mentioned earlier, the annual review of each TIF district allows for the opportunity to examine the performance of the district. This review may reveal that the TID has paid its project costs and could be closed. This is a decent option if the expenditure period has expired, especially if the community is up against the 12% valuation limit and there is a desire to open or expand another district. Occasionally these reviews reveal that a district is not performing well and is not projected to pay off its project costs. While it could be closed with a deficit and its costs covered from other tax revenue, there are other options to help out a struggling TID.

Allocation amendment

If there are multiple TIF districts in a community, it may be the case that one TID is performing well while others are lagging. If so, an allocation amendment allows municipalities to direct revenue from one well-performing “donor” district to an underperforming “recipient” district. Rehab and conservation districts, blight districts, and distressed or severely distressed districts are the only type of districts that can receive tax increments from other districts. The allocation of tax increments from the donor TID can only take place if the donor TID has sufficient revenue to pay off that district’s expenses. It will also delay when the value of the tax increment is available to the overlying taxing jurisdictions. The allocation amendment can take place at any time prior to the closure of the donor district and follows the same process as other amendments described above.

Extensions

The lifespan of a TIF district may also be extended, typically through one of three avenues: a standard extension, technical college extension or affordable housing extension. This does not change the expenditure date, however, which is five years prior to the “normal” end of the TIF district. This means that no new projects can commence after the expenditure date and any projects in process must have either physically begun prior to that 5-year mark, have proof of established funding, and/or a signed developer agreement or contract is in place.

1. Standard extension

A standard extension extends a TID’s maximum life by three or four years to help repay project costs that are not expected to be repaid within the original maximum life of the TID. This extension can only be applied to TIF districts created after October 1, 1995. A rehab and conservation or blight district created between October 1, 1995, and September 30, 2004, is eligible to receive a 4-year extension. Districts formed after October 1, 2004, are eligible to receive a 3-year standard extension. If an industrial or mixed-use district created after October 1, 2004, has been amended to become a donor TID to another district, the standard extension is not available.

2. Technical college extension

A technical college extension is a 3-year extension that can only be applied to districts created before September 30, 2014. This extension is intended to compensate for the loss of tax increment resulting from the shift of technical college funding from the tax levy to the state budget. JRB approval is required and should be based on a finding that the district was affected by that shift in funding.

3. Affordable housing extension

An affordable housing extension is available to any TID that has paid off its costs; it provides one more year of tax increment to be used for affordable housing investment in the community. This option is available to any regular lifecycle TID, one that is closing early, or one that is closing after another type of extension. The decision to seek an affordable housing extension is entirely within a community’s control and can be determined by the local board or council; it does not require Joint Review Board approval. In this scenario, 100% of the funding must go toward investment in housing stock, with 75% in support of affordable housing. Projects may be anywhere within the municipal boundary of a community; they do not need to be within a TIF district. There is also no deadline on the use of the funding accumulated throughout the duration of the extension.

Affordable housing is defined as housing costing 30% or less of any household’s gross monthly income. Since housing thresholds vary by income levels, municipalities are responsible for deciding what types of housing will most benefit their community and how many affordability targets they would like to pursue, whether low-to-moderate (LMI) households, middle income, etc.

The affordable housing extension can be used for a variety of practical and inventive solutions: new housing, redevelopment of existing housing, creating no-interest loan programs to encourage updates, repairing aging infrastructure such as roads and utilities in lower-income neighborhoods, conducting a housing study, or the creation of a plan to assess affordable housing conditions, market demand, gaps and opportunities.

TIF success

When created and managed properly, tax increment districts can be important catalysts for change and an excellent means to encourage economic growth and community renewal in smart, incremental ways. Whether a TIF district already exists in a community or is under serious consideration, municipal leaders must weigh the pros and cons of when and how to open, manage, amend or close such districts.

![]()

![]()

Need help? MSA is well-versed in helping communities analyze opportunities, review performance and determine the best course of action for TIF success. Contact us today to find a TIF expert near you or check out our companion on-demand webinar to hear from our professionals first-hand.