That Funding Feeling

What are your first thoughts when you get that funding award? “We WON?!” “Wow. This project is finally possible!” “Hmm. How is this going to work?” “Seems like a lot of red tape and added requirements.”

“That’s great…now what?”

Introducing the element of funding to a project can generate a variety of feelings, from relief and excitement at new possibilities to frustration and being overwhelmed. Understanding the basics and learning how to navigate—then leverage—your new project resource and all of its intricacies will make your project not only successful, but enjoyable.

The basics

For municipalities just beginning to research funding options, there are two main types of agency funding that are typically awarded: grant and loan.

- Grant – sometimes called principal forgiveness, is award money that does not get paid back.

- Loan – is money that a community is required to pay back to the funding agency but the interest rate is typically subsidized, or is a percentage of the market rate, making it a more affordable option than borrowing from other funding institutions.

Pre-application eligibility check

There are a few factors that may determine which funding sources are best for your project. It is important to consider them prior to applying for a grant or loan:

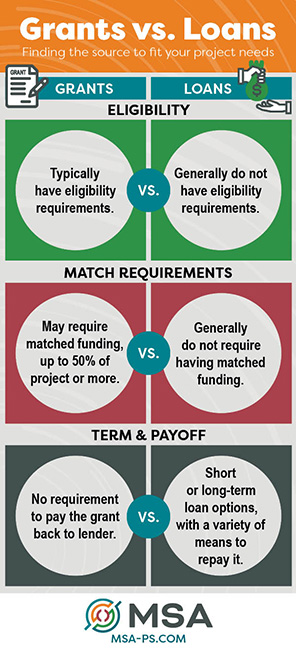

Eligibility

Grants typically have eligibility requirements such as a community’s Median Household Income compared to the state’s Median Household Income or a community’s Low to Moderate Income Percentage in order to qualify.

Loans generally do not have eligibility requirements.

Match Requirement

Some grant funding sources may require match dollars up to 50% of the total project or more. For example, if the project is awarded a $500,000 grant, the applicant may need to “match” that $500,000. Some funding sources allow you to use outside funding sources as a match, others may require the applicant to match using their own internal funds, or some may provide a match to the grant in the form of a loan. Knowing which options are available—or required—is imperative. This is one of many instances where a good, third-party funding expert or consultant can be of great help.

Loans do not generally have any match requirements.

Terms and Means of Payoff

Grants, or principle forgiveness, do not need to be repaid, so no terms are required.

Loans may be repaid over time; however, the length of the term and the means for repayment can vary. Some funding agencies such as USDA Rural Development allow for 40-year loans, while others such as some DNR loans, have shorter terms. Some loans are allowed to be paid off early, but this is situational.

For loan repayment, a community may use any—or a combination—of the following when repaying loans:

- Revenues from Utilities – paid by fees collected from users of sewer, water, etc.

- General Obligation – paid through taxation or fees

- Special Assessments – paid through special taxation or fees created to specifically fund a project

- Tax Increment Financing (TIF) revenue – paid by diverting future property tax revenue increases toward the funded project

Time and cost considerations

Consideration of your project timeline is also vital prior to selecting the appropriate funding source or sources.

Timing

How quickly must your project proceed? Some funds will refinance your project even after completion, as long as it followed the rules. Some won’t touch the project if you put a shovel in the ground before they give their approval (“apparently you don’t need our money”). The same variance can apply to match dollars. Know the specifics and requirements before making any formal agreements.

Eligible Project Costs

Some funding sources will only pay for the construction portion of a project while other sources cover a wider scope of services: engineering fees, funding services, land/easement costs, etc.

Funding Requirements

Grant-funded Zander Place brownfield redevelopment in Cross Plains, WI

Some funding has more particular, fine-print requirements that can add unexpected time or additional cost to a project, such as: environmental review, use of American Iron and Steel and Davis Bacon Wage Rate Monitoring.

Expert services for funding success

Navigating the world of funding is not always made simple. Yet, when successfully completed, there is no greater excitement than knowing that a long-awaited project will finally come to fruition.

Make your funding applications count. Research all funding source eligibility requirements, review the full gamut of state and federal funding options and scrutinize all the fine print. Work to maximize your funding win, minimize your out-of-pocket match and reduce restrictive added costs.

Or, just sit back and relax a bit.

Lighten your load and let funding and administrative experts do the legwork for you. MSA works with both the public and private sectors to obtain funding through both public and private sources.

Newport Park in Lake Delton, WI, bundled state and federal grants to reduce cost by 65%.

We believe that utilizing multiple funding sources for projects helps maximize funding dollars and minimize cost to the applicant. It is our promise to work with you to determine the most affordable path to project funding.

We also believe that project funding is a full-circle commitment. Communities and clients deserve to be supported all the way through closing and closeout of funding, with administrative, municipal advisory and engineering services to accompany all aspects of the funding acquisition. MSA has the associated teams and resources to help.

Because a funding ‘win’ means a project ‘win,’ which means a broader community ‘win’ – and you just can’t argue with that.

Learn more about MSA’s funding solutions and how we can help kick-start your next project.